By Anurag Agrawal, CEO, Techaisle

Over the last two decades, the global small and midmarket businesses, SMB (1-999 employee size) market has been the growth engine for the IT industry at large. The reason is quite simply that SMBs account for more than 80 percent of businesses in any country – developed or developing. For much of those two decades, SMBs have primarily focused on building core infrastructure with the bulk of their investment allotted towards buying PCs and desktop applications such as Office, desktop publishing and other industry specific software.

Over the last two decades, the global small and midmarket businesses, SMB (1-999 employee size) market has been the growth engine for the IT industry at large. The reason is quite simply that SMBs account for more than 80 percent of businesses in any country – developed or developing. For much of those two decades, SMBs have primarily focused on building core infrastructure with the bulk of their investment allotted towards buying PCs and desktop applications such as Office, desktop publishing and other industry specific software.

This initial phase was followed by a longer continuing phase wherein SMBs shifted their investments to Networking technologies. However, this was still part of core infrastructure investments made by SMBs. And now that core is shifting. 2012 was the year when IT Investments began to shift towards emerging technologies:

• Mobility solutions and devices including tablets, mobile line of business applications.

• All things cloud from cloud advertising to cloud infrastructure.

• Mixing and matching of Virtualization technologies.

• Rapid adoption of managed services.

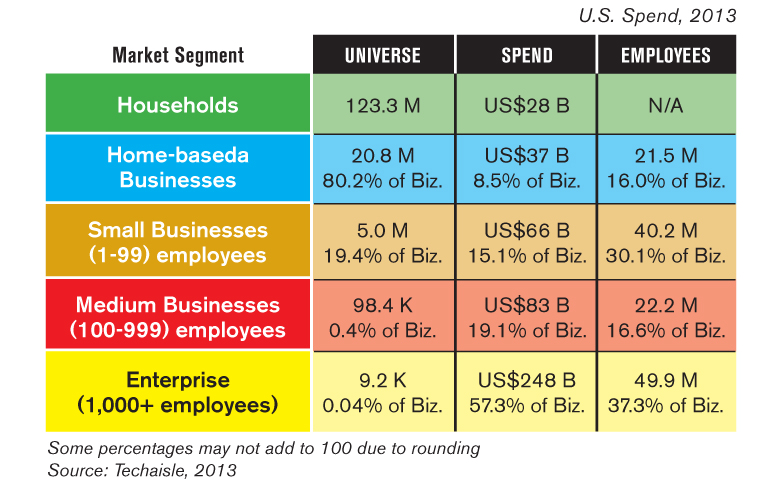

SMBs form the essential thread of the economic fabric of any country and to a great extent their fortunes and investment capabilities are dependent on the economic situations and policies of the countries they represent. Including home-based businesses into the mix, SMBs and HBBs together 99.9% of businesses in the U.S.and are collectively expected to spend US$214 billion on IT in 2013, as shown in the chart (Fig. 1).

SMBs form the essential thread of the economic fabric of any country and to a great extent their fortunes and investment capabilities are dependent on the economic situations and policies of the countries they represent. Including home-based businesses into the mix, SMBs and HBBs together 99.9% of businesses in the U.S.and are collectively expected to spend US$214 billion on IT in 2013, as shown in the chart (Fig. 1).

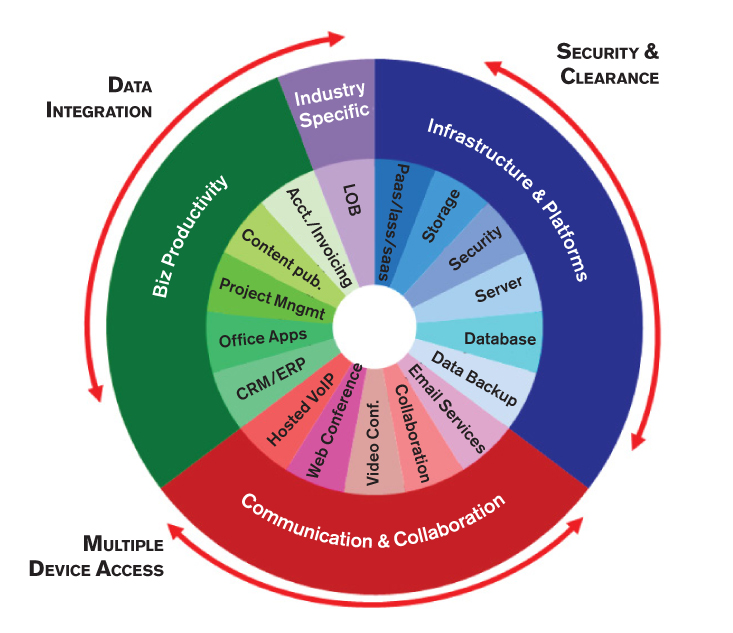

Connectivity and Collaboration will be the primary computing scenarios of SMB IT departments and Virtualization, Cloud, Mobility, Managed Services will together form the Four Pillars of IT that will support the transformation of SMB, enabling them to reach their full potential in the shortest period of time. The foundation for these four pillars will be the datacenter, both off-site and on-premises.

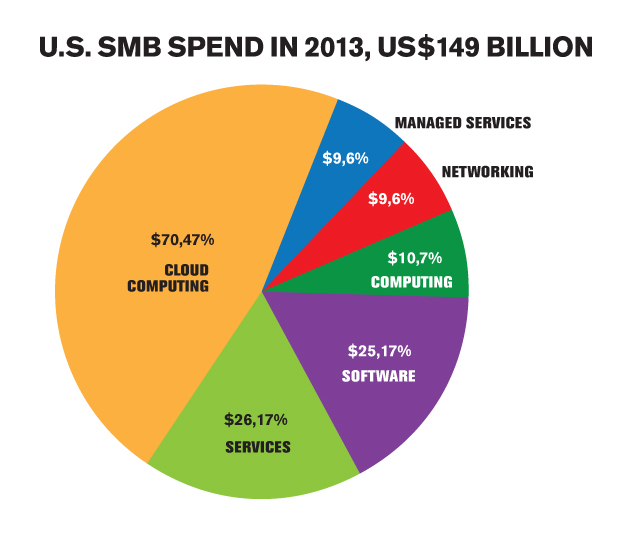

U.S. SMB IT Spend Market Size: US$149 Billion

Let us focus our attention on the U.S. SMB segment, (1-999 employees), which is forecast to spend US$149 billion on IT in 2013, a projected growth of 6.5 percent from 2012. While small businesses will continue to spend on hardware and software, majority of spend for mid-market comes from services will come from consulting, integration and IT management. IT Spend changes drastically as businesses move from segment to another; average spend on IT by a mid-market business (100-999 employees) is 65 times that of a small business (1-99 employees).

Let us focus our attention on the U.S. SMB segment, (1-999 employees), which is forecast to spend US$149 billion on IT in 2013, a projected growth of 6.5 percent from 2012. While small businesses will continue to spend on hardware and software, majority of spend for mid-market comes from services will come from consulting, integration and IT management. IT Spend changes drastically as businesses move from segment to another; average spend on IT by a mid-market business (100-999 employees) is 65 times that of a small business (1-99 employees).

One of the areas we watch most is the evolving needs of the SMB customer, who is being consistently pressured to speed up all core business processes while simultaneously reducing costs, generally through the introduction of new technologies and specifically by adopting Cloud Computing approaches. IT services will continue to constitute a large share of the overall US SMB IT spend, but what is more interesting is that Cloud and Managed Services will begin to establish themselves. Together they will have a 12 percent share of spend, up from 10 percent.

Networking: Still an Important Area of SMB IT Spend

In the era of cloud computing where storage and processing happens off-site, there is still a very strong need for networking equipment that is efficient, scalable, secure, and flexible with highbandwidth capacities. Therefore it is not out of place to expect that SMBs are forecast to spend US$10 billion on networking equipment in 2013. The equipment includes switches, routers, appliances and communication. In a recent study Techaisle found that SMBs, especially, mid-market businesses are re-designing their network architecture to become “more suitable” for cloud usage.

Among Mid-Market companies (between 500 and 999 employees) recently interviewed, over 75 percent described their business being completely “Network Dependent” with a large share planning to move beyond Virtualization to Software-Defined-Networking (SDN) and Software-Defined-Data-Centers (SDDC). Almost all had implemented Remote Managed Services (RMS), Cloud Computing, and Server Virtualization or VDI.

Rise of Mega CRM

Software-as-a-Service (SaaS) will continue to be a big investment area for SMBs coming in at US$3.2 billion in 2013. Traditional CRM will still be a huge investment and growth opportunity; U.S. SMBs could spend as high as US$500 million on vertical SaaS applications. The adoption of cloud-based productivity suites among SMBs will accelerate which will begin to balance usage of collaborative and individual SaaS applications. We expect SMB Cloud productivity suites spend will almost double to US$152 million in 2013 from relatively slow adoption through 2012.

SMBs’ emphasis on front-office, revenue-generating applications will continue with CRM at the hub and with more marketing automation and business intelligence applications. The base of marketing automation vendors will continue to consolidate as start-ups fail and pure-plays are acquired and big players roll out integrated solutions. Cloud CRM spend will continue to grow at a healthy rate of 20 percent.

Data Integration: The Big Kahuna?

Hybrid Data Integration could well become The Big Kahuna in 2013, and it is forecast to be nearly US$3 billion opportunity in 2013. Although, overall, SMBs will spend more than US$20 billion on development and integration, a large part of it will continue to be enhancement of current applications and new implementations.

Hybrid Data Integration could well become The Big Kahuna in 2013, and it is forecast to be nearly US$3 billion opportunity in 2013. Although, overall, SMBs will spend more than US$20 billion on development and integration, a large part of it will continue to be enhancement of current applications and new implementations.

There will be a significant increase in emphasis on data integration rather than application integration as SMBs will want data to be combined from several sources to power different application blocks and embedded business intelligence functionality. As Cloud computing adoption among SMBs grows, the real issue of data integration will come into play. As we see it, there are clearly four stacks of Cloud offerings and it will become imperative for each stack to communicate with the other stack.

One of the last things that SMBs need is a high-cost of application and data integration, a cost that may become higher than the applications they are using. SMBs do not have the time or the budget for such integrations. It is a given that SMBs will continue to work in a hybrid environment with both desktop software and cloud based applications in simultaneous use.

Virtualization Driven by BDR and Costs

Techaisle’s U.S. SMB Virtualization survey shows that 29 percent of U.S. SMBs are planning to use Server Virtualization in 2013. It is a clear indication that Server Virtualization, already an imperative technology investment within enterprises, is cascading down to mid-market businesses (100-999 employees) as well as small businesses (1-99 employees). The highest planned adoption is within 50-99 employee size businesses. However, highest current usage is within the 500-999 employee size businesses.

Of the SMBs that are planning to use server virtualization, nearly one-fourth plan to have 75 percent or more of their servers virtualized. In fact 15 percent of these SMBs plan to have 100 percent of their servers virtualized which is nearly twice as high from current 9 percent of SMBs that have virtualized 100 percent of their x86 server real estate. The survey also shows that 4 times as many small businesses are virtualizing 100 percent of their servers as mid-market businesses.

SMBs cite several reasons for adopting server virtualization; key among them are reducing operating cost, backup and disaster recovery and reducing cost of IT support. Improving existing server and hardware systems utilization is mentioned by 32 percent of SMBs.

Targeting the $40 Billion Mobility Opportunity

Mobility has entered the SMB workplace in a big way. In 2013, there will be:

• 32.5 million employees within U.S. SMBs that will be mobile.

• 12.3 million SMB employees will be telecommuting.

• 27.7 million SMB employees will be traveling locally for work.

• 16.2 million SMB employees will be traveling beyond 50 mile radius either by bus, car, train or plane.

• 17.6 million SMB employees will be using one or more cloud applications.

However, it is extremely important to understand that not all SMBs are investing in mobility equally and therefore understanding the segmentation and developing scores for each type of SMB customer will help in creating target accounts. Techaisle’s ANN (Artificial Neural Networks) based segmentation shows that there are three distinct SMB segments of mobility solution users:

• Aggressive Adopters: Mobility is Strategic to their business; these form 13 percent of SMBs.

• Steady Movers:Mobility is enabled in their business; by far the largest segment at 49 percent of SMBs.

• Fence Sitters: Mobility is a convenience for their business; these form 19 percent of SMBs.

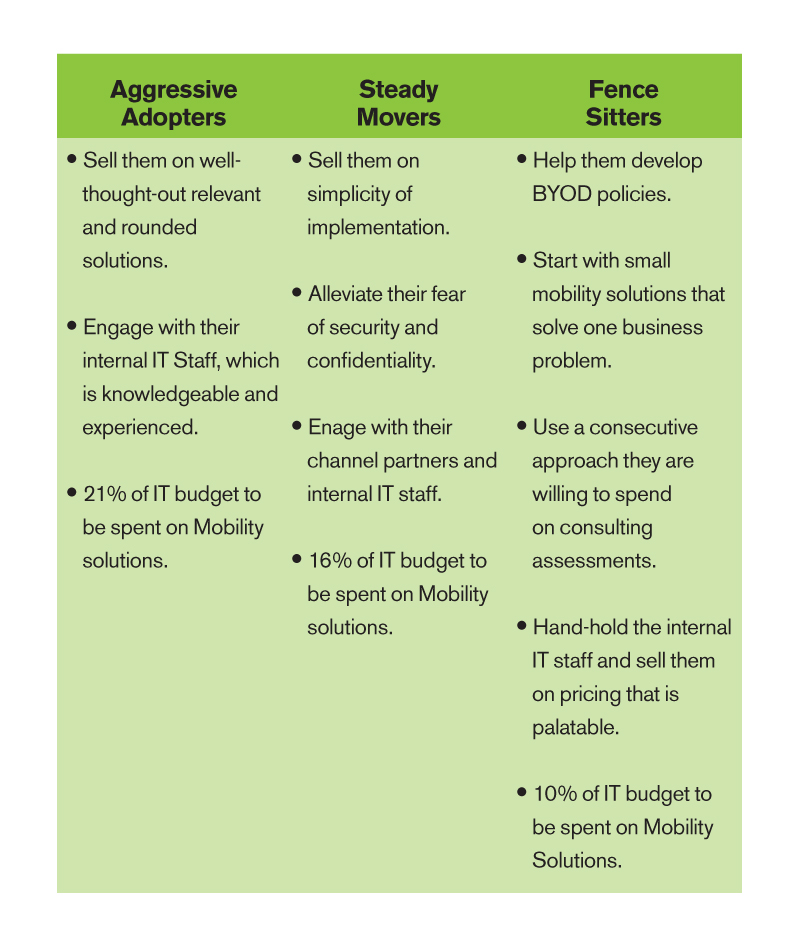

Sales Strategies for SMB Mobility Segments

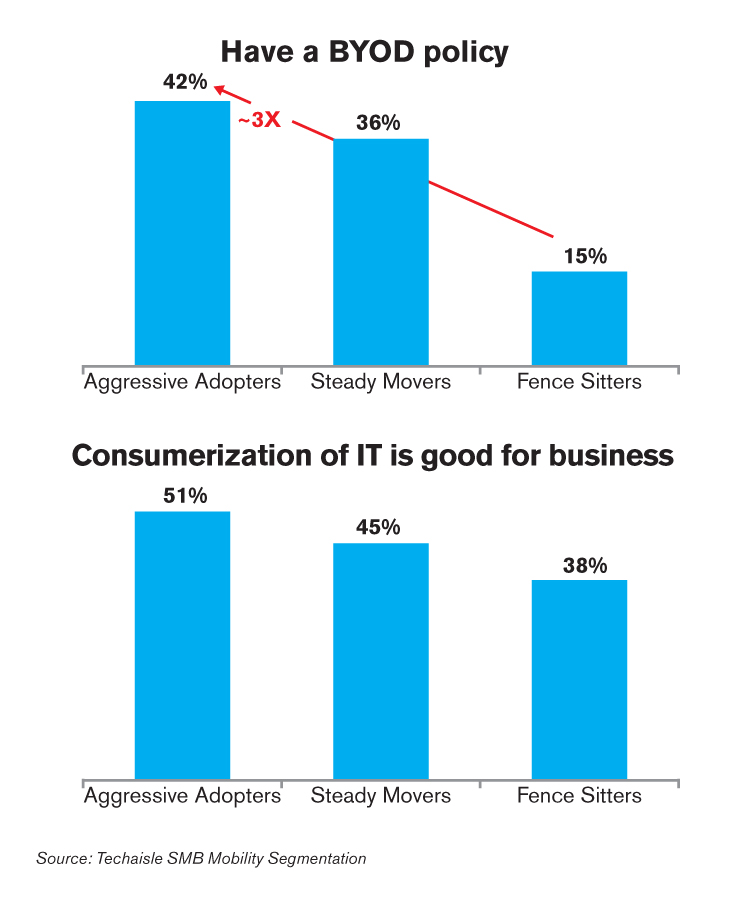

Aggressive Adopters have also moved quickly to implement a BYOD policy whereas a large percentage of Steady Movers do not have a BYOD policy but they also do not stop their employees from using their own devices.

Aggressive Adopters have also moved quickly to implement a BYOD policy whereas a large percentage of Steady Movers do not have a BYOD policy but they also do not stop their employees from using their own devices.

Aggressive Adopters also have a very healthy attitude towards employees using consumer applications at work as they feel it is a good way to learn about technology that their employees find useful and can be officially integrated into their business.

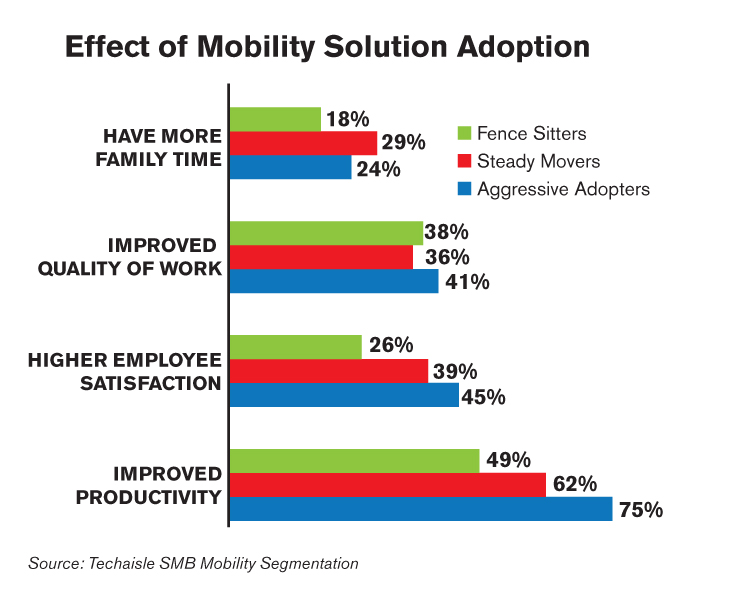

Adoption of mobility solutions has also led to a positive effect on work-life balance of their employees. Aggressive Adopters have also seen improved productivity, higher employee satisfaction and improved quality of work.

Adoption of mobility solutions has also led to a positive effect on work-life balance of their employees. Aggressive Adopters have also seen improved productivity, higher employee satisfaction and improved quality of work.

The 2013 SMB IT opportunity is real and present. Recognizing the SMB need is the first most important step towards capitalizing on the opportunity.