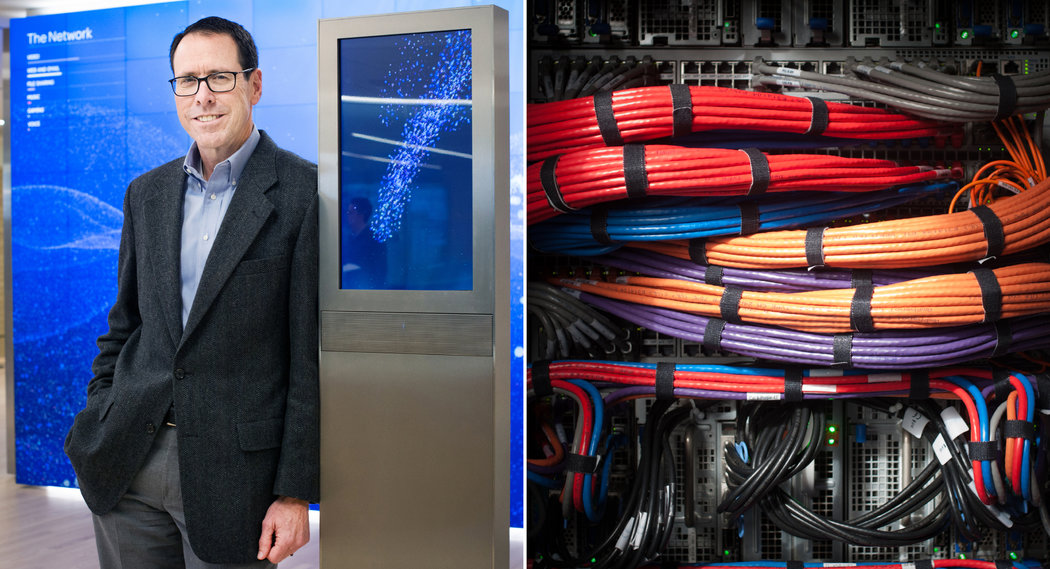

“There is a need to retool yourself, and you should not expect to stop,” said Randall Stephenson, the chief and chairman of AT&T. He is reinventing the company for a cloud-heavy future. Credit Brandon Thibodeaux for The New York Times

DALLAS — Thirty-four years ago, Kevin Stephenson got his younger brother, Randall, a job with the telephone company.

Kevin, then 23, and Randall, 22, had tried selling cattle feed with their father near their home in Moore, Okla., but that didn’t pan out. Kevin was hired to do accounting at a local Southwestern Bell office. Randall, who was in college, needed a bit more help. “He had trouble getting hired,” Kevin said. “I talked to someone I knew in personnel.”

The brothers had different tastes. Kevin liked to be outside, and now, at 57 years old, he works in Norman, Okla., fixing the decades-old copper lines that still connect to landline telephones in most homes as well as to modern Internet conduits like high-speed fiber optics. Randall liked numbers and stayed indoors, rising through the management ranks.

Southwestern Bell became SBC Communications and took on the old AT&T name through an acquisition in 2005. By 2007, Randall was running the place.

Today, Randall Stephenson, AT&T’s chairman and chief executive, is trying to reinvent the company so it can compete more deftly. Not that long ago it had to fight for business with other phone companies and cellular carriers. Then the Internet and cloud computing came along, and AT&T found itself in a tussle with a whole bunch of companies.

AT&T’s competitors are not just Verizon and Sprint, but also tech giants like Amazon and Google. For the company to survive in this environment, Mr. Stephenson needs to retrain its 280,000 employees so they can improve their coding skills, or learn them, and make quick business decisions based on a fire hose of data coming into the company.

In an ambitious corporate education program that started about two years ago, he is offering to pay for classes (at least some of them) to help employees modernize their skills. But there’s a catch: They have to take these classes on their own time and sometimes pay for them with their own money.

To Mr. Stephenson, it should be an easy choice for most workers: Learn new skills or find your career choices are very limited.

“There is a need to retool yourself, and you should not expect to stop,” he said in a recent interview at AT&T’s Dallas headquarters. People who do not spend five to 10 hours a week in online learning, he added, “will obsolete themselves with the technology.”

Kevin? He admires his younger brother, but he is among the many AT&T lifers who are not that keen to participate in this reinvention of old Ma Bell. “I’m riding the copper train all the way down,” he said.

He talks about the changes with obvious affection for both his brother and his longtime employer. In interviews, many veteran AT&T employees around the country showed a surprising amount of emotion toward a company that has been broken up, rebuilt and reinvented several times.

But that doesn’t mean everyone is particularly eager to rebuild and reinvent themselves for a new AT&T. Even if it means, as Randall put it, obsolescence.

Companies’ reinventing themselves to compete with more nimble competitors is hardly a new story. Many have tried, and a handful have even succeeded. Mr. Stephenson wants AT&T to be among those few.

In the last three years, he has spent more than $20 billion annually, primarily on building the digital business. DirecTV was acquired in a $63 billion deal last year, and several billion more was spent to buy wireless businesses in Mexico and the United States. Even for a company with $147 billion in 2015 revenue and over $400 billion in assets built up over more than a century, it’s a lot.

By 2020, Mr. Stephenson hopes AT&T will be well into its transformation into a computing company that manages all sorts of digital things: phones, satellite television and huge volumes of data, all sorted through software managed in the cloud.